Renters' Rights Ready? 10 pointed questions to ask your software partner

Many lettings providers claim to meet all your Renters' Rights Bill needs. Here are all the questions you should ask them to put those claims to the test.

A term used by several letting agent software providers, including Goodlord itself.

But what does it actually mean? And how can you tell if your provider's promises are genuine?

Well, by asking the questions below, you can test their resolve and ensure they don't spring any nasty surprises down the line...

- Communication - How will you ensure my tenants and landlords receive and acknowledge updates on their new rights? How will you provide documented proof of compliance?

- Payments - With first-month rent payments now split into several transactions, how will you help me track, chase, and reconcile them?

- Tenancy fraud - Does your tenant referencing process include any manual document validation checks?

- Compliance - Are your right-to-rent, AML, PEPs, and sanctions checks centralised and automated?

- HMOs - What’s your solution for managing shared tenancies efficiently?

- Transition to periodic tenancies - How will you ensure I use the right contract type at the right time, especially as the commencement date approaches?

- Section 13 process - How will you support my agency to serve Section 13 notices and avoid appeals to rent increases?

- Preventing discrimination claims - How do you protect my business from discrimination claims when selecting tenants?

- Insurance claims and Section 8 notices - Can you help with insurance claims and Section 8 notices, including ensuring I have the proper documentation to process them?

- Profit margins - How does your solution help me maintain my margins?

Hit the links above to flick through, or keep scrolling for more 👇

1 - Communication

Question

How will you ensure my tenants and landlords receive and acknowledge updates on their new rights? How will you provide documented proof of compliance?

Risk

You may need to send tailored communications to each tenant and landlord, with proof that messages were received and acknowledged. The average agent manages hundreds of tenants and landlords, so the scale of this challenge is significant.

How Goodlord can help

If you manage 300 tenancies, you may need to send 750 unique communications. An average of 3 minutes per communication equals a whole working week of admin, give or take.

Goodlord drastically reduces this by sending tailored communications to every tenant and landlord at the right time. Our system also provides proof of delivery and acknowledgment, ensuring compliance.

2 - Payments

Question

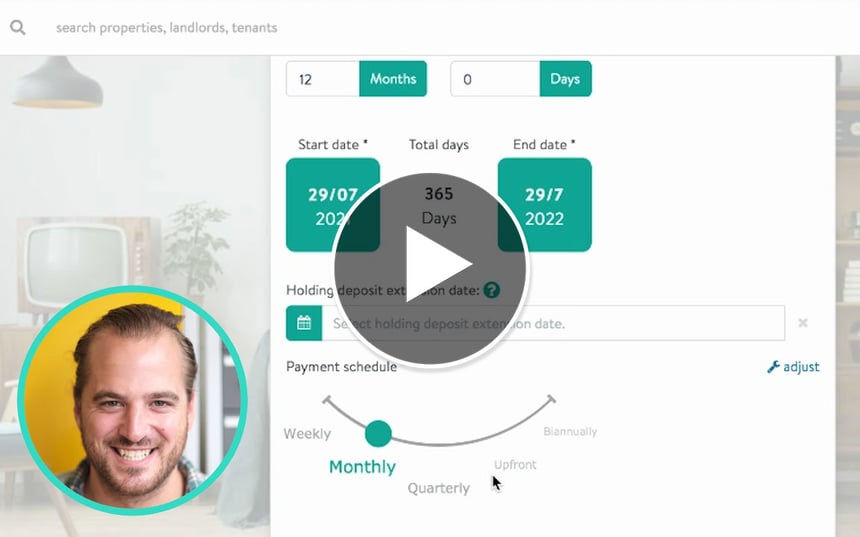

With first-month rent payments now split into several transactions, how will you help me track, chase, and reconcile them?

Risk

Agents will now handle a higher volume of rent transactions, increasing the workload for tracking, reconciling, and chasing outstanding payments.

For example, the Bill will make it illegal for tenants to pay the first month’s rent before they’ve signed the tenancy. If a tenant moves in midway through a month, you may also need to collect two separate payments, including:

- One for the partial month

- Another for the next 30 days

How Goodlord can help

Goodlord automates payment requests, tracks rent collection, and reconciles payments seamlessly. Our platform also:

- Assigns tenants unique bank accounts to ensure accurate reconciliation

- Chases tenants for overdue payments automatically, ensuring no payments slip through the cracks

- Flags any issues with payment timing, such as requesting rent before a contract is signed

3 - Tenancy fraud

Question

Does your tenant referencing process include any manual document validation checks?

Risk

94% of tenancy fraud cases involve forged documents. Many of these cases can’t be detected by the human eye, making automated validation checks essential.

How Goodlord can help

By using payroll providers and open banking to validate financial records, we prevent tenancy fraud from happening in the first place. This gives you the best chance of placing high-quality tenants in your landlords’ properties.

4 - Compliance

Question

Are your right-to-rent, AML, PEPs, and sanctions checks centralised and automated?

Risk

Using multiple providers increases the risk of human error, delays, and non-compliance.

How Goodlord can help

Goodlord seamlessly performs right-to-rent, AML, PEPs, and sanctions checks. This reduces friction in the compliance journey, improving the experience for both tenants and agents. For example:

- Tenants submit their details in one place, rather than repeatedly across multiple platforms

- Agents don't need to chase missing documents or manually verify compliance requirements across different providers

5 - HMOs

Question

What’s your solution for managing shared tenancies efficiently?

Risk

Tenancy swaps will disappear under the Renters' Rights Bill. This means you'll have to process a brand-new tenancy if one tenant from a shared property decides to leave. Existing tenants who stay on may also need to be re-referenced, even if you previously verified their financial and rental history.

How Goodlord can help

To help you overcome these challenges, Goodlord:

- Automatically creates new tenancy agreements using existing tenant data

- Covers referencing costs for re-contracting tenancies within 12 months

6 - Transition to periodic tenancies

Question

How will you ensure I use the right contract type at the right time, especially as the commencement date approaches?

Risk

As the commencement date of the Bill approaches, you’ll need to serve both ASTs and periodic tenancies simultaneously, depending on when a contract starts. If a tenant's move-in date changes, the contract type may also need to be updated.

Because of this, you risk sending the wrong contracts at the wrong time, which could void agreements and allow tenants to leave properties prematurely.

How Goodlord can help

Goodlord automatically identifies the contract type based on the move-in date. Our system also flags when a contract needs to be amended due to a tenant's move-in date change.

7 - Section 13 process

Question

How will you support my agency to serve Section 13 notices and avoid appeals to rent increases?

Risk

When the Bill becomes effective, landlords can only raise the rent once per year using a Section 13 notice. Failure to track dates effectively will delay rent increases, eating into your margins.

Meanwhile, raising the rent higher than the market rate could result in tenant appeals. As things stand, rent increases won't be backdated even if a tenant loses an appeal.

How Goodlord can help

Goodlord automatically populates Form 4, ensuring all the information in a Section 13 notice is correct. The platform also provides rent review reminders, ensuring you serve Section 13s with at least two months’ notice.

Finally, Goodlord’s Rental Index allows you to benchmark rent increases against local averages, helping to prevent tenant appeals.

8 - Preventing discrimination claims

Question

How do you protect my business from discrimination claims when selecting tenants?

Risk

The Bill will make it illegal to discriminate against tenants on benefits and with children, and you also need to consider pet requests. A lack of transparent pre-qualification and decision documentation leaves you vulnerable to legal action.

How Goodlord can help

Goodlord offers unlimited pre-qualification tools that fairly assess all applicants based on best-fit criteria rather than their circumstances. Our system automatically documents the selection process, ensuring you can show the fairness of your decision-making process.

9 - Insurance claims and Section 8 notices

Question

Can you help with insurance claims and Section 8 notices, including ensuring I have the proper documentation to process them?

Risk

Serving a Section 8 eviction notice relies on precise record-keeping. Plus, landlords could face significant financial losses during extended legal battles without a solid rent protection solution. This means your commission won’t be paid.

How Goodlord can help

Goodlord’s market-leading Rent Protection & Legal Expenses package covers the first month’s rent and pays out until vacant possession. This protects landlords through extended court delays as well as your management fees.

The platform also stores all necessary documentation for insurance claims and Section 8 notices, making retrieving and submitting required evidence easy.

10 - Section 13 process

Question

How does your solution help me maintain my margins?

Risk

Tenancy renewals traditionally provide the highest profit margins for agents, and their removal is a huge blow. Due to increased tenant flexibility, tenancies could also become shorter, further reducing the predictability of your income.

How Goodlord can help

Charging to serve Section 13 notices will allow you to replace some of your lost renewal revenue. Offering rent protection insurance will also ensure that you and your landlords are financially safeguarded against shorter tenancies and unexpected rent loss.

Conclusion

If your current provider can’t answer all of these questions, it might be time to look for an alternative. Hit the button below to speak with our team 👇

.png)