Content by category

Filter the latest lettings news and insights by category.

Keep updated with our latest articles

Insights

Explore the latest lettings data, including average rents and void periods.

Solutions

Discover how Goodlord's lettings platform could help your agency.

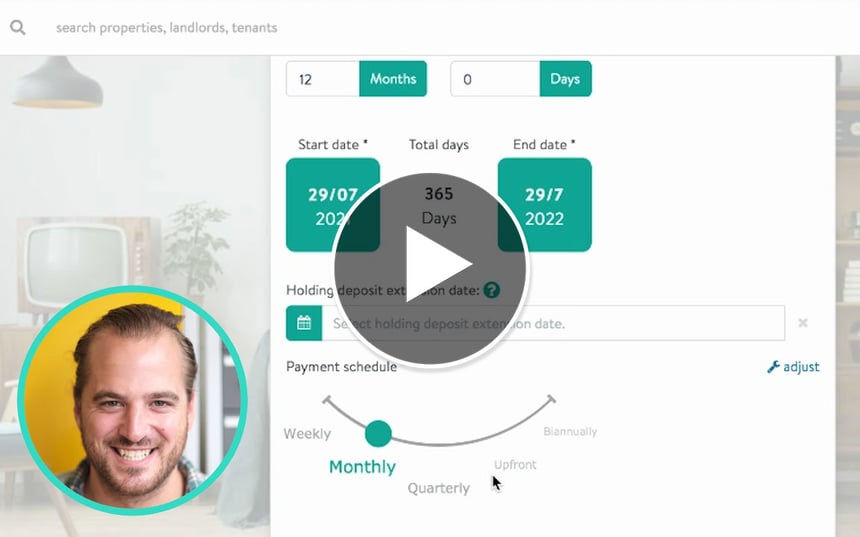

See how Goodlord works with our on-demand demo

Watch nowDiscover why Goodlord is in a league of its own

Leave us your details and we’ll be in touch as soon as possible to show you how Goodlord can help your lettings business.

Need some help with Goodlord? Visit our Support Centre.Thanks for your interest in Goodlord. We don't provide services directly to landlords but we work directly with letting agents up and down the country who utilise our additional products, such as insurance, to create the best renting experience in the world. If you'd like us to put you in touch with a Goodlord agent in your area, please use this form to help us pair you up with an agent that meets your needs.

If you need some help with Goodlord, please visit our Tenant Help Centre in the first instance. If you are unable to find the answer you need, then our Support Team will be on hand to help you.

Want to get in touch with us? Please use this form, or send us an email at info@goodlord.co.