Simplify lettings, maximise revenue

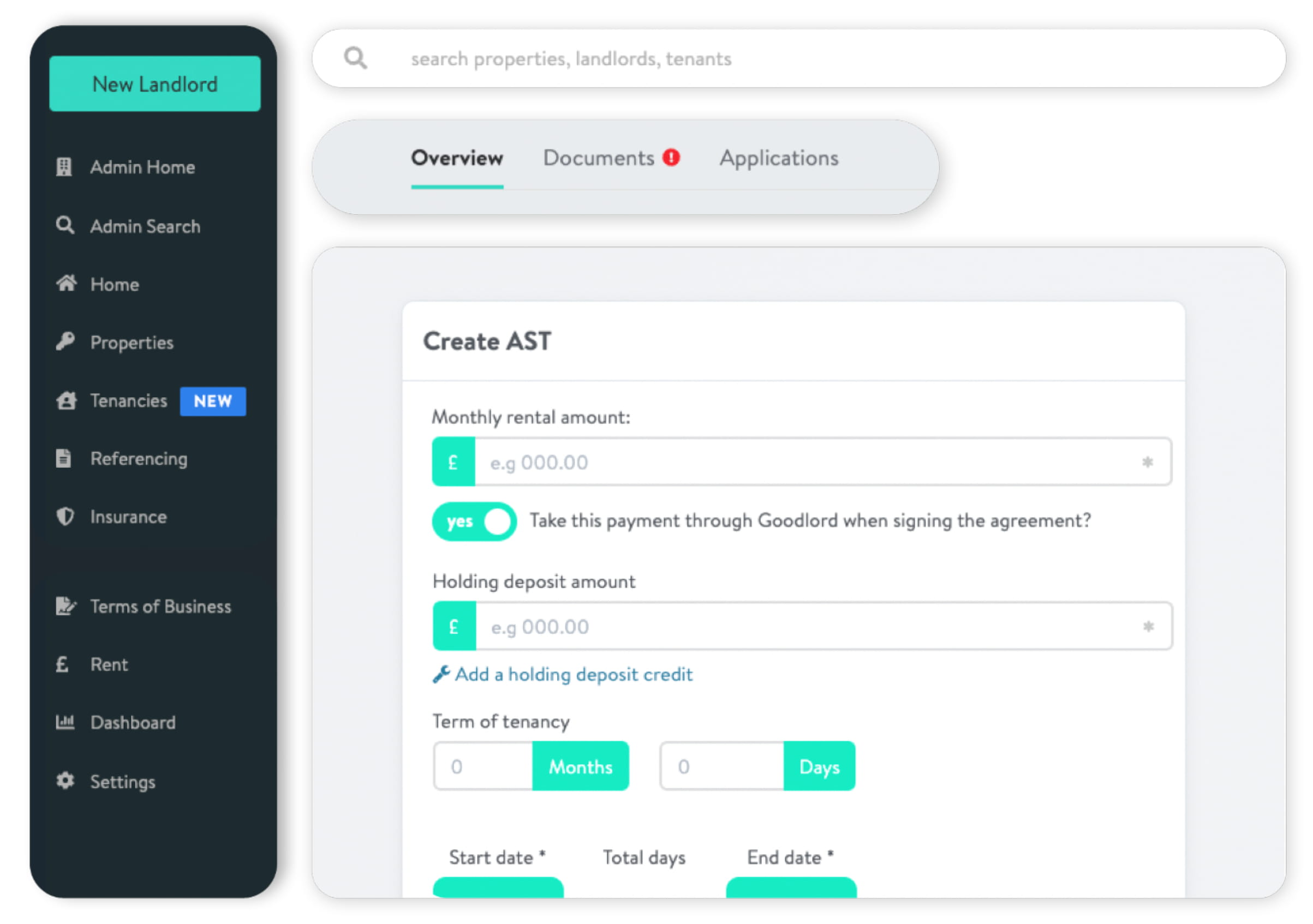

Manage your properties in one place while staying compliant. Our digital platform handles the entire lettings process, from offer letter to rent collection, all while helping to boost your agency's revenue.

TRUSTED BY MORE THAN 1,500 AGENCIES UK-WIDE

.jpg)

What does Goodlord do?

What can you do with Goodlord?

Handle the whole lettings journey - from referencing to rent collection - and everything in between.

Why Goodlord

How can agents benefit from one digital platform?

Processing more than one million tenancies a year, Goodlord can save you time, money, and energy - or all three.

25%

more tenancies

Grow your business. Elevation Lettings increased their tenancy potential by 25%.

3

hires per year

Keep overheads down. With Goodlord, Lease for Life saves money on unnecessary hires.

Why Goodlord

Why do lettings agents choose Goodlord?

More than 1,500 agents use Goodlord across the UK. See what they have to say about us.

.png)

London

“If you want to provide your landlords and tenants the best customer satisfaction, Goodlord is the best digital tool."

David Phillips

Propfinity

Greater London

“Goodlord has helped us replace some of the lost revenue from the dip in new business we’re seeing, with the current supply and demand imbalance”

Rick Purdy

Dawsons

Greater London

“With Goodlord, there’s just more time to actually generate business”

Sarah Wycherley

White & Sons

Platform demo

Explore the platform

Watch our 4 min demo

Find out how you can empower your team to deliver more value.

Speak to the Goodlord team today.