Could more regulation of short-term lets in England help fix rental property shortages?

The government is considering a register for short-term lets in England. Will that fix supply issues in the private rented sector? Anita Nel from Vouch has her say.

Anita Nel

Aug 3, 2022

The government has put out a call for evidence on developing a tourist accommodation registration scheme in England, aiming to collect data on the size and shape of the market, as well as the impact of short-term lets. The consultation comes hot on the heels of the announcement that councils will be given more powers to charge higher rates of council tax on empty and second homes, and that business rate relief for second homes will face restrictions. But what could this mean for the supply of long-term lets?

Defining short-term and holiday lets

First, let's define what a short term let actually is. The call for evidence outlines that a short-term let is "offering a residential accommodation to one or more paying guests", where the guest doesn't treat the property, or part of it, as their principal home. The property in question could be a whole flat or a single room, or even a caravan or houseboat.

The reason for the short stay can also vary. It may be for a holiday, or it could be for work or to stay somewhere short-term while a home is being refurbished, for example. However, short-lets differ to hotels, which wouldn't otherwise be used as a place of residence.

Outside London, there's no set limit on the number of days a property can be let out on a short-term basis. However, a six-month or above contract is traditionally considered a long-term let.

The need for change

The government consultation paper highlights the boost to the economy that short-term and holiday rentals can give, with more choice for consumers and the chance for homeowners to make some extra money.

However, it also recognises that it's hard to apply and enforce regulations in the holiday let sector - such as those under the Management of Health and Safety at Work Regulations 1999 - and that it can have an impact on housing supply in local communities and levels of anti-social behaviour.

This is where the register aims to help. The register would work alongside the previously announced tax changes which aim to encourage empty homes back into "productive use" and "keep council tax down for local residents," according to the government's levelling up policy paper.

Past policies for short-term lets

The government has historically been seen to favour the short-let sector with its tax policies, according to Ben Beadle, chief executive of the National Residential Landlords Association.

He says that previous tax changes for landlords and their taxable profits around mortgage interest costs actually incentivised landlords to join the short-let sector, "to the detriment of long-term sustainable renting”.

“What we see today is entirely a problem of the government’s own making, which has decimated rented housing supply when demand is at record highs,” he says.

Growth in the short lets sector

Travel restrictions and heightened demand for staycations have also encouraged an uptick in the number of short-term lets - with recent figures showing that 77% of British people plan to holiday in the UK in 2022.

Research by the insurance firm Quotezone found a 102% increase in the number of UK holiday homes let out, when comparing January to May 2018 - the last "normal year" before the pandemic - to the same period in 2022.

Property listings and short-term lets

The actual impact of short lets on rental stock is a difficult picture to paint, as the consultation document acknowledges.

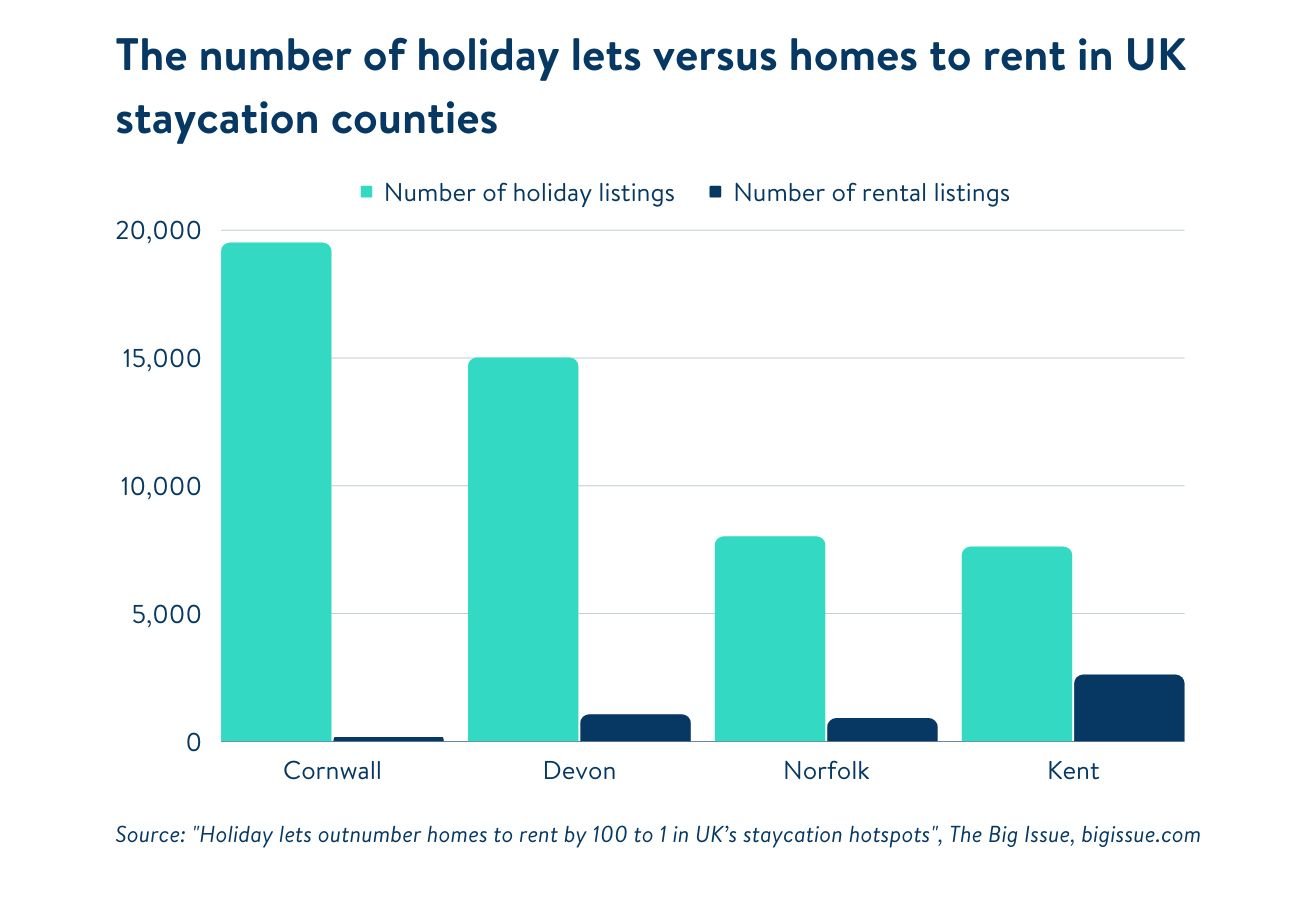

The Big Issue reports that holiday lets in tourist hotspots in the UK outnumber homes available to rent 100 to one, when comparing listings - as outlined in the graph below.

AirDNA found similar results for Cumbria, to a lesser extent, at 36 holiday lets for every one rental home. However, Amanda Cupples, General Manager of Airbnb Northern Europe, claims that there's "no evidence base that has drawn any link whatsoever between short term accommodation and housing scarcity.”

AirDNA found similar results for Cumbria, to a lesser extent, at 36 holiday lets for every one rental home. However, Amanda Cupples, General Manager of Airbnb Northern Europe, claims that there's "no evidence base that has drawn any link whatsoever between short term accommodation and housing scarcity.”

She says that Airbnb listings represent many types of accommodation - including barns, yurts and individual rooms - meaning that any data comparing the number of rental listings is "inherently flawed".

Long versus short-term lets for landlords

Moving away from listings data and looking at survey results, Propertymark estimated in 2020 that 46,000 properties have already been made unavailable for local people looking for a home due to private landlords changing from long-term to short lets - and one in 10 landlords would consider switching to short lets, under the current regulatory framework.

However, this also needs to be balanced with the appetite for buy-to-let investment. In the first three months of 2022, landlords bought 42,980 homes in Great Britain. This begs the question that, if more regulation were introduced for short lets, would this tip the balance in favour of the PRS?

Interest in holiday lets

Anecdotal reports suggest that the announced tax changes are already starting to encourage some holiday let landlords to leave the sector in England. In Wales, this is more pronounced, with 1,400 holiday let owners surveyed saying that they were considering leaving the sector before new occupation rules come into play.

The question then becomes, what happens next? Will these properties be snapped up as primary residences? Will buy to let investors swoop in - helping boost housing rental stock in the private residential sector?

Holiday lets are still an attractive option for investors - the Holiday Let Outlook Report 2022 from Sykes shows that enquiries from prospective holiday home investors increased by 78% in 2022 vs. 2021. So, there's a chance that these second homes may simply fall back into the short-lets market.

The severity of any new restrictions will be the deciding factor for whether this investment interest continues to grow or wanes in time - and therefore whether more properties will eventually end up in the hands of owner-occupiers or private landlords.

What does this mean for letting agents?

Whatever the impact on the rental market, short-term lets could present an opportunity for letting agents. As properties become more regulated, landlords may turn to agents to help ensure they meet all of the required safety measures, and manage the properties in the best way - a potential new revenue stream for agencies.

"The tightening of regulations, requirement to register, and higher fines and prosecutions should drive up standards and may see some of the 82% of landlords currently self-managing turning to agents to ensure they remain compliant and avoid financial penalties," says Sally Lawson, Agent Rainmaker.

"But in order to embrace this, agents must concentrate on offering a diverse range of services, catering to landlords whose portfolio (or target portfolio) covers LHA, HMOs and short-term accommodation."

With the cost of living crisis ongoing, the government will have a tough job taking into account the economic benefits of holiday rentals and balancing this with the need to provide long-term homes for renters.

We wait to see the results of the consultation to learn if regulating short-term lets could be a solution to help resolve these challenges and help boost the supply of rental properties.

Goodlord and Vouch are part of the Goodlord Group. Goodlord also offers a referencing service to complement its lettings software for agents.

.jpg)